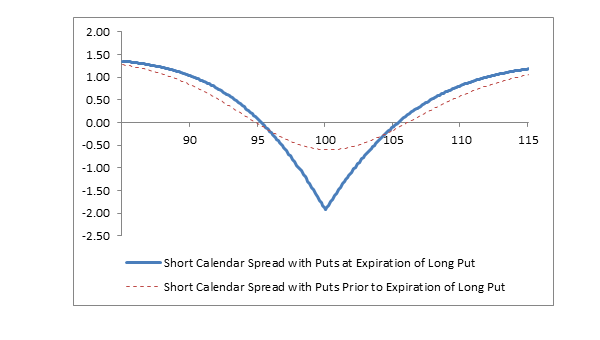

Short Put Calendar Spread – The short put spread — or “bull put spread,” as it’s also described — is a relatively conservative option strategy, since the profit potential is strictly capped. In execution, it bears a strong . Een short put is de Engelse beschrijving van een optiepositie bestaande uit een geschreven put-optie. Een short put is de Engelse beschrijving van een optiepositie bestaande uit een geschreven .

Short Put Calendar Spread

Source : www.fidelity.com

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Source : optionalpha.com

Short Calendar Call Spread | Learn Options Trading

Source : marketchameleon.com

Calendar Spreads in Futures and Options Trading Explained

Source : www.investopedia.com

Calendar Spread Definition: Day Trading Terminology Warrior Trading

Source : www.warriortrading.com

Calendar Put Spread – Options Edge

Source : theoptionsedge.com

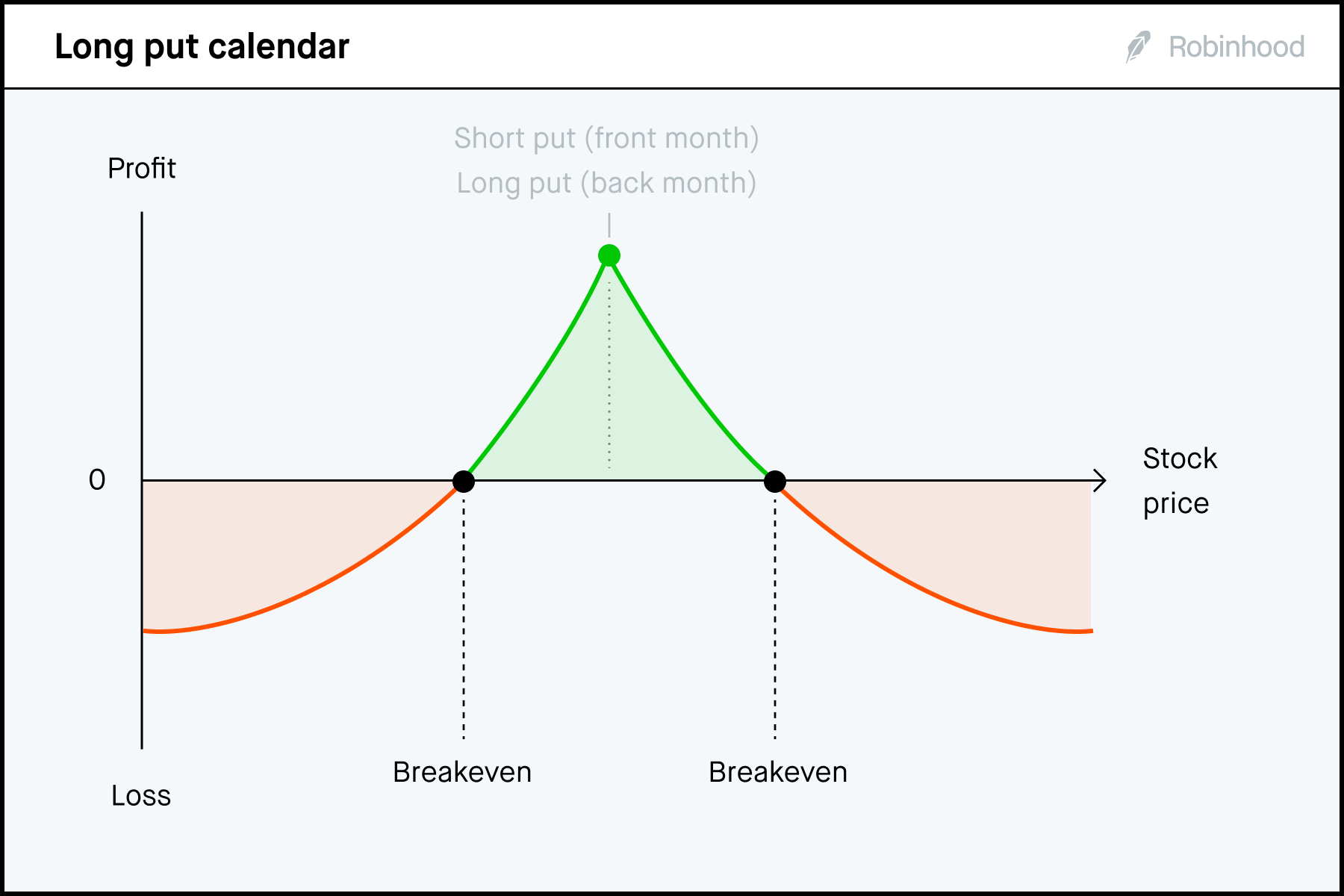

Advanced options strategies (Level 3) | Robinhood

Source : robinhood.com

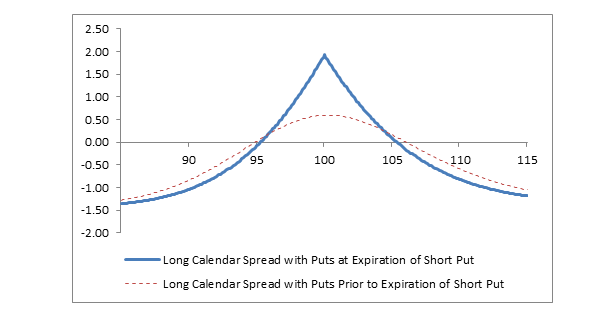

Long Calendar Spread with Puts Fidelity

Source : www.fidelity.com

Short Call Calendar Spread (Short Call Time Spread)

Source : www.optionseducation.org

Calendar Put Spread – Options Edge

Source : theoptionsedge.com

Short Put Calendar Spread Short Calendar Spread with Puts Fidelity: Your maximum possible loss on the long put calendar spread is capped to your initial net debit of 0.60, or $60. Even if XYZ plummets to zero and you’re assigned on the short put, your obligations . AI versterkt Phone Link voor Android met antwoordsuggesties 31 mei 2024 11:54 Oude Chrome-extensies worden binnenkort uitgeschakeld .

:max_bytes(150000):strip_icc()/calendarspread.asp_final-6628bf3928bd4717bde925a70b28ac8c.png)