Future Calendar Spread – The Calendar spread definition can be understood in terms of the simultaneous purchase and sale of two futures contracts on the same underlying for different maturity contracts. For example . In my previous article, I highlighted the buy or sell spread trades, which could be described as intra-market or calendar spreads, as they involve buying a futures contract in one month while .

Future Calendar Spread

Source : www.investopedia.com

Getting Started with Calendar Spreads in Futures Exegy

Source : www.exegy.com

Leg Up on Futures Calendar Spreading luckbox magazine

Source : luckboxmagazine.com

Calendar Spread Trading | Eris Futures

Source : www.erisfutures.com

What is a calendar spread in futures trading? Quora

Source : www.quora.com

Calendar Spreads – Varsity by Zerodha

Source : zerodha.com

Option Calendar Spreads CME Group

Source : www.cmegroup.com

What Exactly Are Futures Spreads | StoneX

Source : blog.stonexone.com

The Double Calendar Spread

Source : traders.com

Create Futures Spreads with SpreadTrader

Source : www.interactivebrokers.co.uk

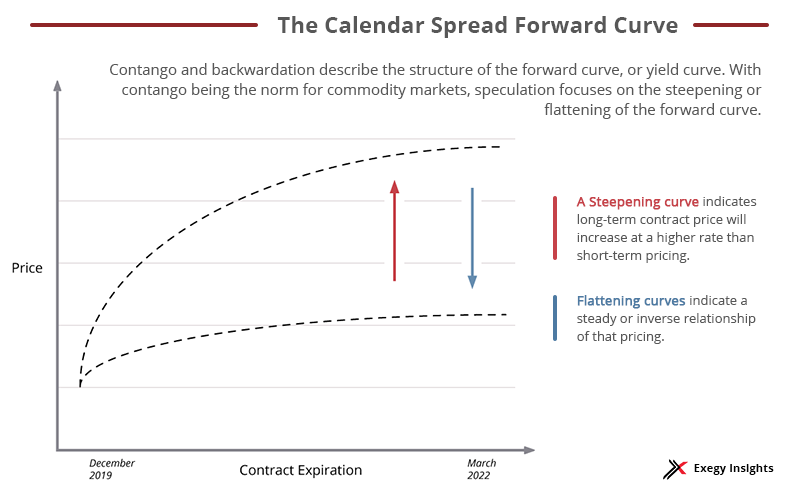

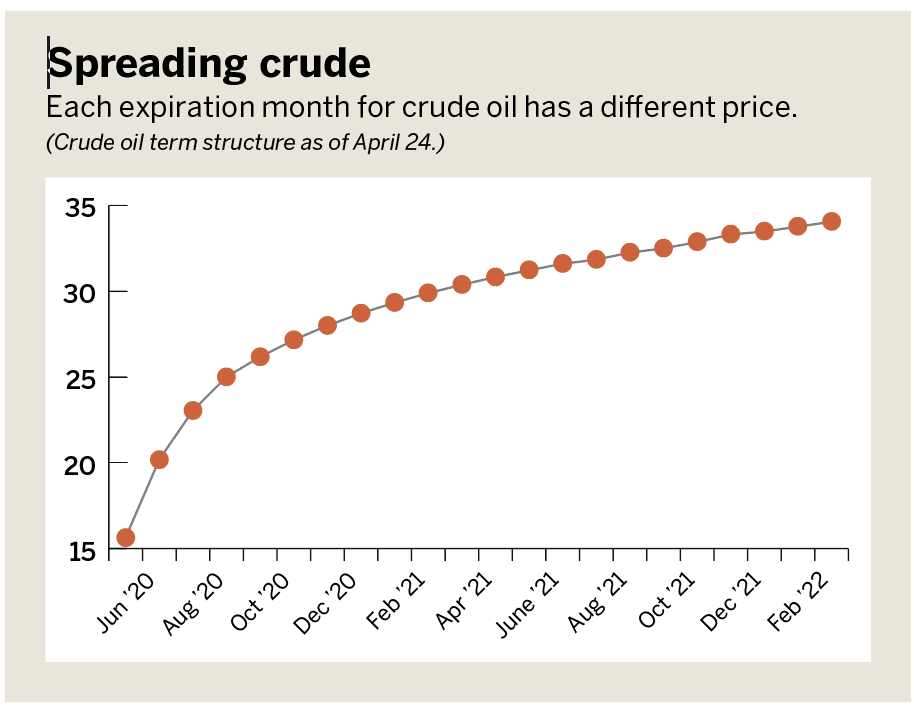

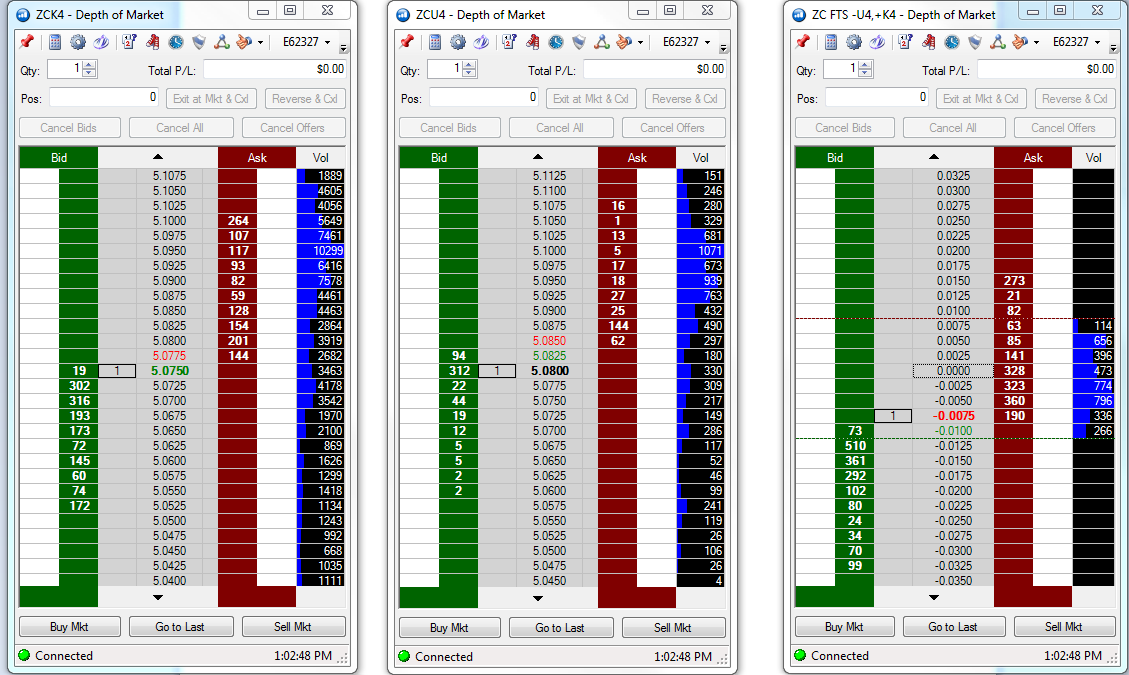

Future Calendar Spread Calendar Spreads in Futures and Options Trading Explained: Calendar spread indicate what is the gap in prices of two different expiry contracts of a particular commodity. This shows whether that commodity is moving in contango or backwardati . This article will focus on the Copper calendar spread. HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY For a limited time, you can receive my Futures Training Videos for free with a 3-month, 6-month, .

:max_bytes(150000):strip_icc()/calendarspread.asp_final-6628bf3928bd4717bde925a70b28ac8c.png)